One of the first questions people have when considering buying in Hawaii is about property tax. Related to Hawaii property taxes is the Homeowner Exemption for property owners who reside in their property.

A second concern is what the taxes are if you are considering buying a property for rental income. Related to this is the General Excise Tax license and the Transient Accommodations Tax license.

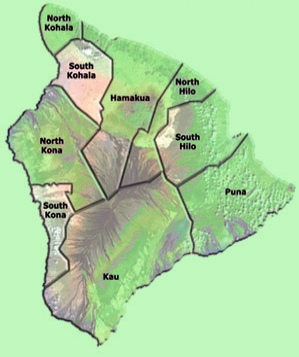

County of Hawaii Real Property TaxesThe real property taxes for the county of Hawaii (the Big Island) can be found at the County of Hawaii Real Property tax site. If you are looking for property on another island, taxes may differ as property taxes are set by the counties.

County of Hawaii Homeowner Exemption formsIf you purchase a property in Hawaii County and are planning on living in it, please apply for the Homeowner Exemption. You will save hundreds of dollars on your property taxes with the Homeowner Exemption in place.

The basic Homeowner Exemption is $40,000, subtracted directly from the value assessed by the county on the property. The exemption is higher if you are over 60 years of age and/or if you are disabled. Whatever exemption you have moves with you, the taxpayer, but you must do the "moving" yourself. If you sell a home with a Homeowner Exemption on it, you must tell the county tax office that the exemption no longer applies to that property.

You must apply for the Homeowner Exemption. Additional information and the form(s) may be obtained using the links below.

- Homeowner Exemption Brochure

- Claim for Home Exemption (form)

- Disability Exemptions Brochure

- Forms related to disability exemptions

There is no sales tax in the State of Hawaii. The State's General Excise Tax (G.E.T.) taxes on the gross receipts or gross income individuals, corporations, partnerships, or other entities derive from their business activities in Hawaii. It may look like a sales tax when you buy something in a store and you pay tax, but actually that is an example of the retailer passing the excise tax on to the consumer. The tax to the retailer is currently 4% of the gross receipts, but because he collects the tax, he also pays tax on the 4%, so the retail general excise tax passed on to the consumer is 4.167%.

If you have rental properties in the State of Hawaii, you must get a General Excise Tax license and pay the excise tax on your rental proceeds. If you have rental properties that you are renting to people short term (less than 180 days), you will also have to acquire a Transient Accommodations Tax license and pay the transient accommodations tax on your short term rentals. The Transient Accommodations Tax (T.A.T.) is currently 9.25%.

To apply for the above licenses, you must complete the State's Basic Business Application. The Department of Taxation has the application on its website. You may complete it online, print it and send it in with the appropriate registration fee(s).

You must, in addition, pay income tax on rental income, whether you live in the State or outside the State. There is also a very complete brochure at the State website which answers many questions about collecting both the General Excise Tax and the Transient Accommodations Tax and addresses some of the income tax issues. Rental Brochure.

HARPTA Withholding for Non-Resident Sellers of Real PropertyUnder Hawaii law, if the seller of real property is a non-resident person or entity, the purchaser of the property must withhold a specified percentage of the "amount realized" by the seller and forward that amount with the appropriate form to the Department of Taxation. The seller may file a Certificate of Exemption with the State, or the seller may apply for a waiver on Form 288B, in which cases the buyer will not be required to collect the withholding. It has been my experience that the withholding is usually 5% of the sales price of the property. If a seller does pay the withholding, all or a portion of it may be refunded back to the seller upon filing income taxes with the State at the end of the year. Please go to the link that contains the tax forms and instructions connected with the HARPTA withholding for more information. HARPTA withholding forms

Hawaii Conveyance Tax on Real PropertyIn Hawaii, all documents transferring an interest in real property, including all leases of five or more years, must be accompanied by a conveyance tax certificate. Within 90 days of any disposition of real property, the seller must pay a conveyance tax. The deed cannot be recorded until the Conveyance Tax Certificate has been filed and paid. Excluded from this requirement because the recipients have paid no consideration, is property received through probate of an estate, as a gift under the laws of descent, as the result of the death of a joint owner, property where the consideration may be nominal and is thus less than $100, or property transferred at the time of satisfaction of an agreement of sale. There are two sets of rates, one rate applies if the purchaser of the property is eligible for a county homeowner's exemption and the other rate, which is higher, applies if the purchaser is not eligible for a county homeowner's exemption. Please click this link from the Hawaii Board of Realtors to see the rates.